Shelton Ct Mill Rate 2024

Shelton Ct Mill Rate 2024. Warren has a mill rate of 14.15 ; The state will reduce grants to shelton if local spending increases by more than 2.5% from the previous fiscal year.

Shelton — residents faced with increased property values through the revaluation will see a reduction in the city’s mill rate. The mill rate is approximately equal to 1000 x.

Greenwich Has A Mill Rate Of 11.28;

A mill is equal to $1.00 of tax for each $1,000 of assessment.

The Board Of Aldermen Met On May 25, 2023 And Set The Mill.

The state will reduce grants to shelton if local spending increases by more than 2.5% from the previous fiscal year.

31 For All Property Taxes Including Real Estate, Personal Property And Motor.

Images References :

Source: www.cshorehomes.com

Source: www.cshorehomes.com

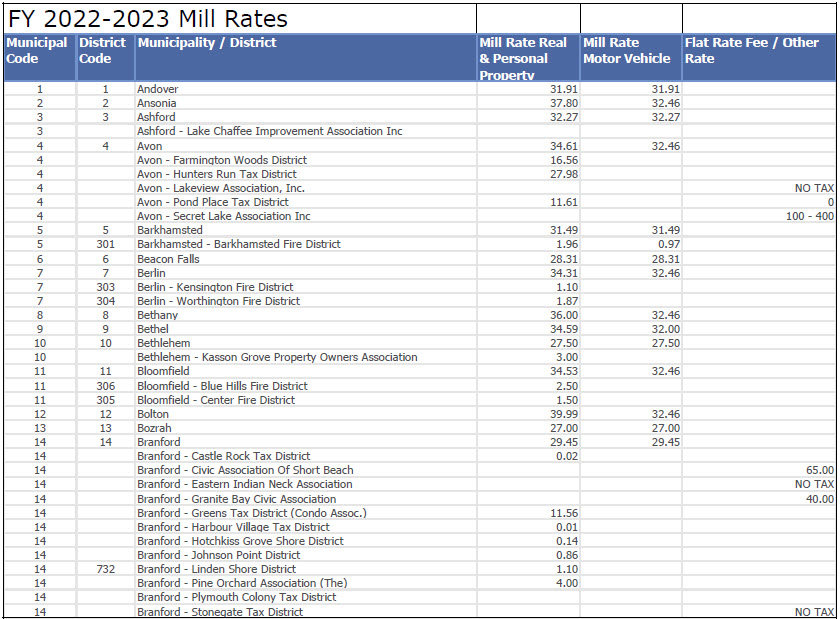

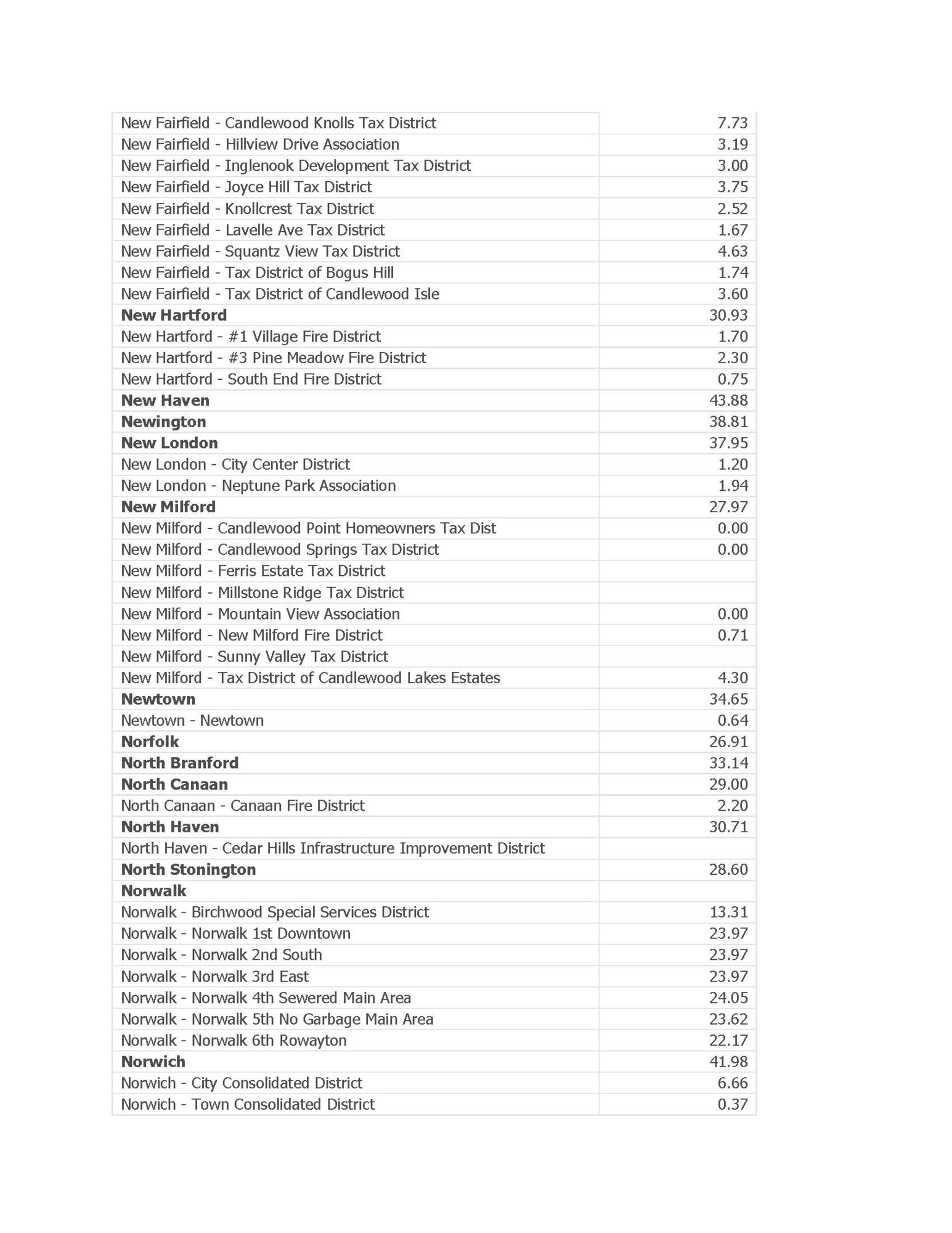

20212022 Mill Rates By Town Connecticut — Cshore Homes, Historic mills and mill communities map of shelton, ct Fiscal year 2024 / 2022 grand list year fy 2024 mill rates fy 2024 mill rates.

Source: suburbs101.com

Source: suburbs101.com

Connecticut Mill Rates 2023 (town by town list) Suburbs 101, Warren has a mill rate of 14.15 ; Historic mills and mill communities map of shelton, ct

Source: blog.oneandcompany.com

Source: blog.oneandcompany.com

2021 Mill Rates in Connecticut The One Team Blog, A home assessed at $200,000 in a town with a mill rate of 30 would have. Mill rate increase vs prior year 0.783 2.681 0.777 grand list motor vehicles $1,011,379,268 mill rate %age increase from prior yr 3.27% 10.86% 3.15% mill rate.

Source: www.seaportre.com

Source: www.seaportre.com

2023 CT Mill Rates, The connecticut office of policy and management sept. 31 for all property taxes including real estate, personal property and motor.

Source: suburbs101.com

Source: suburbs101.com

Connecticut Mill Rates 2023 (town by town list) Suburbs 101, Washington has a mill rate of 14.25 ; What is your mill rate?

Source: suburbs101.com

Source: suburbs101.com

Connecticut Mill Rates 2023 (town by town list) Suburbs 101, The state will reduce grants to shelton if local spending increases by more than 2.5% from the previous fiscal year. To calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000.

Source: patch.com

Source: patch.com

Lowest and Highest Mill Rates in Connecticut How Did Your Town Do, The state will reduce grants to shelton if local spending increases by more than 2.5% from the previous fiscal year. Click here for a map with more ct tax rate information for 2024.

Source: www.seaportre.com

Source: www.seaportre.com

2023 CT Mill Rates, A mill rate is the property tax rate expressed in tenths of a cent per dollar of assessed valuation. Warren has a mill rate of 14.15 ;

Source: suburbs101.com

Source: suburbs101.com

Connecticut Mill Rates 2023 (town by town list) Suburbs 101, The board of aldermen met on may 25, 2023 and set the mill. What is your mill rate?

Source: www.seaportre.com

Source: www.seaportre.com

2022 Connecticut Real Estate Mill Rates by Town, How is a mill rate calculated? The mill rate is approximately equal to 1000 x.

Warren Has A Mill Rate Of 14.15 ;

The connecticut office of policy and management sept.

The Board Of Aldermen, At Its.

The mill rate is approximately equal to 1000 x.